Is USDA right for you?!

Not just for farms.

Many homes qualify, putting your dream of home ownership within reach! You don’t even have to live in the boondocks.

USDA offers a great way to get into a new home with no down payment and minimal PMI* required.

*Good catch! USDA does not have mortgage insurance, but it does have an annual fee that is applied monthly to the payment. For most, it’s easy to explain as a PMI.

What makes USDA great for you

0% Down

One of the few fixed rate loan options available with no down payment required.

Low Credit Options

USDA is a great option for imperfect credit scores.

More Homes Qualify

Yes- non farmers can apply! Rural and rural adjacent are eligible, even some suburbs on the outskirts of a metro. The USDA gets to define “rural” and over 90% of US land qualifies!

Competitive FIXED Rates

USDA consistently offers some of the lowest rates in the market. Your rates are locked in keeping your monthly payment consistent for the life of your loan.

Finance Your Closing Costs

That’s right! You can even finance your closing costs if the total loan amount doesn’t exceed the appraised value of the property.

Low and Moderate Income Families Are Eligible

Flexible requirements put home ownership within reach! USDA loans can be used on existing homes, new construction, and foreclosures.

Who is eligible?

The USDA loan option is typically available to applicants who meet credit requirements and local area income requirements. Applicants must also be purchasing a home in an area that is not considered a major metropolitan area by USDA. Or refinancing their existing USDA mortgage.

Who it's great for:

Simpler process

Can be used for primary residence, 2nd homes, investment / rental properties

Available for *most residential properties

As little as 3% down (that’s $10,500 on a $350,000 house)

Higher credit scores = better rates

Lower closing costs

Fewer appraisal requirements

NO monthly mortgage insurance with as little as 3% down

Common Misconceptions

USDA loans are only for farmers.

You don’t even have to grow a garden to qualify for a USDA loan. Small family homes on a normal size lot within city limits can qualify too.

I need a great credit score to apply.

Yes - it’s true, FHA loans typically offer great interest rates for homebuyers.

FHA or Conventional loans are better.

It depends on what “better” means to you. For eligible buyers, USDA loans can actually offer better rates and terms than the others, including lower PMI (private mortgage insurance).

USDA Loans are tough to get.

You don’t even have to grow a garden to qualify for a USDA loan. Small family homes on a normal size lot within city limits can qualify too.

USDA doesn’t finance renovations.

The no down payment lets you keep some cash in your pocket for those updates as well. We also have other options to let you improve the property to make it what you want.

I won’t qualify.

We don’t know that for sure yet! USDA is a very achievable loan option for many home buyers. Let’s talk about your specifics to see if USDA is a loan option for you.

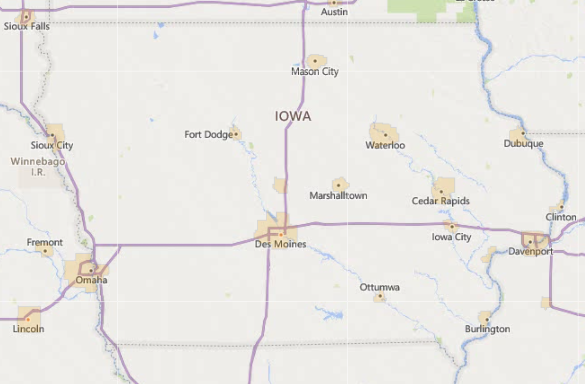

See the areas in Iowa eligible for USDA loan.

(Yellow = ineligible areas)

Get a personalized review.

There are many great benefits of a USDA loan, it might be the mortgage option that best meets your needs.

We can take a look at your unique situation to give you a personalized review.

Let us know you’re interested by filling out the form below.

We are not the US Department of Agriculture. If you wish to contact them, you may do by visiting their site at www.usda.gov.

Specific underwriting requirements apply, inquire to verify your specific eligibility.